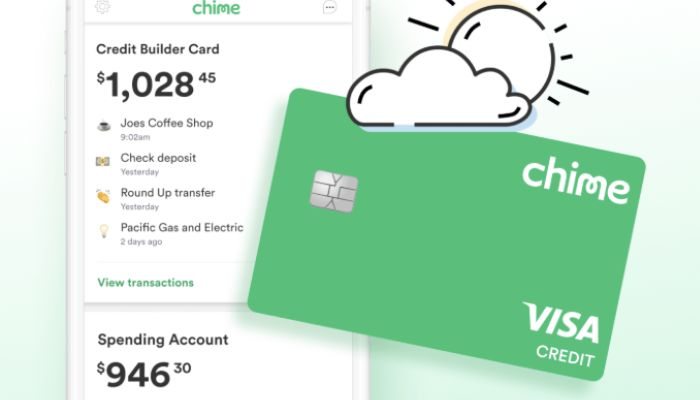

The Chime credit card is a modern financial solution offered by fintech Chime, which provides a simplified credit experience with no hidden fees. Unlike traditional cards, Chime has no maintenance fees, annual fees or late fees, allowing users to keep your finances under control without unexpected costs, the card is integrated with the Chime app, which makes managing finances easier, allowing users to track their transactions in real time, view their available balance and manage their budget with ease.

To use the Chime credit card, you must first open a Chime checking account, as the card is linked to that account, once requested and received, the card can be used to make purchases anywhere that accepts credit cards, either in physical stores and online, through the application, users can monitor transaction alerts and protect the card against fraud, in addition to paying the balance directly from the current account, this integration and simplicity make the card an attractive option for those looking for a financial solution practical and hassle-free

How does the Card Work?

The Chime credit card is a modern and affordable alternative to traditional cards, standing out for its transparency and simplicity. With no maintenance fees, annual fees or late fees, the card provides an experience without additional costs other than the interest applicable in case of non-payment of the full balance. Managed by the Chime app, it allows users to track their transactions in real time, view their available balance and control spending with ease.

In addition to its no-hidden-fee approach, the Chime credit card is widely accepted and offers security features like transaction alerts and the ability to lock or unlock the card through the app. To use it, you need to have a Chime checking account, which makes it easier to pay your balance and integrate your personal finances. This combination of simplicity, security and efficient management makes the card an attractive option for those looking for a practical and hassle-free financial solution.

Benefits

The Chime credit card offers several benefits that make it an attractive option for those looking for simplicity and financial control. One of the main attractions is the absence of hidden fees; The card has no maintenance fees, annual fees or late fees, which helps you avoid unexpected costs and maintain control over your finances without surprises. Integrated with the Chime app, the card allows you to manage your expenses in a practical way, tracking transactions in real time and viewing your balance intuitively.

In addition to financial simplicity, the Chime credit card provides additional security and control. The app offers transaction alerts and the ability to lock or unlock your card remotely, which helps protect against fraud and gives you greater control over your card usage. Integration with the Chime checking account makes it easy to pay your balance and manage your finances, while the ability to build and maintain a healthy credit history adds an additional benefit that is essential for future credit needs

How to Use

To use the Chime credit card, the first step is to open a Chime checking account, as the card is linked to that account. The account opening process is simple and can be done directly through the Chime app. Once you have your checking account active, you can request a credit card through the application itself, which makes the request quick and convenient.

Once you receive the card, you can manage it through the Chime app, which allows you to track your transactions in real time, check your available balance, and create budgets to better control your spending. The card can be used for purchases both in physical stores and online, in the same way as a traditional credit card. To keep your finances in order and avoid interest, it is recommended that you pay the full balance of your bill by the due date, which can be done directly from your Chime checking account through the app. Additionally, the app offers features to monitor transaction alerts and protect the card against fraud by allowing you to block or unlock the card as needed.